Retirement Planning Fundamentals Explained

Wiki Article

The Greatest Guide To Retirement Planning

Table of ContentsIndicators on Retirement Planning You Need To KnowThe Main Principles Of Retirement Planning See This Report on Retirement PlanningThe Basic Principles Of Retirement Planning

12 percent. By 2007, that same 175 monthly stood for a puny 7. 47 percent of what they earned. By 2007, the other 2 pairs were spending a great deal even more cash than Sam and Kate. Yet that didn't issue. These 2 early risers still skyrocketed higher. According to, they would certainly have had regarding 1 million by the time they were 65 years of ages without ever before raising the month-to-month quantity they spent.They didn't begin to spend until they were 35 years old. They invested 600 a month (7,200 per year) in 1987.

Therefore, they weren't able to invest as much of their revenue on the finer things in life. When Sam and Kate asked Stuart and Lisa to join them for a South African safari, they couldn't manage it. Their month-to-month retired life cost savings ate up far way too much of their earnings.

:max_bytes(150000):strip_icc()/Term-p-pension-plan-Final-85353401500f4add804371082e83da3a.jpg)

The 8-Minute Rule for Retirement Planning

The lesson right here is enormous yet easy! Sam and Kate started to spend in 1977. They would have saved an overall of about 84,000 to generate 1 million. Stuart and also Lisa started to spend 10 years later on. They would certainly have invested concerning 216,000 to reach a 1 million profile.

Because of this, they needed to conserve regarding 432,000 to reach their million-pound turning point by age sixty-five. If they had begun to spend 10 years later (at age 55) they would not have gotten to that objective also if they had actually spent every cent they gained! We are not saying you need 1 million to retire. retirement planning.

We all have goals and we will still have goals when we retire. For a retired person, it might be hard due to the fact that many goals require money and also if at that factor in your life, you do not have enough retirement advice savings, you may not be able to achieve your retired life objectives.

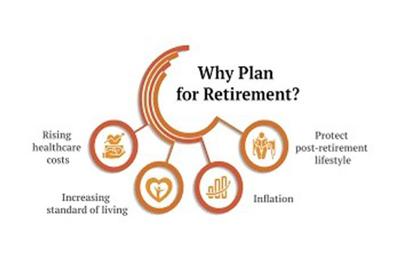

This is on significance of retirement preparation. With a retired life strategy that enables you to save and invest the funds in your retired life account, you can grow the funds as well as make them enough for post-retirement.

Indicators on Retirement Planning You Should Know

While there is nothing incorrect with exploring what the globe has to provide, and also experiences are undoubtedly a fantastic financial investment in yourself, you should also intend for your future. Assume long and also hard about it.Before you understand it, the years have passed and also you might not have any financial savings left to tide you over. Having a significant quantity of money established aside for your retired life years can guarantee you of a comfortable life in the future. This allows you to be financially independent, not having to Learn More Here rely upon children, grandchildren, or relatives to sustain you when the moment comes - retirement planning.

Purchasing a retirement as early as feasible will certainly offer you the opportunity to make even more which might make it possible to retire early, allowing you to delight in the returns on your financial investment while you still have the power to do so. Do invest in experiences. But additionally designate part of your cash where it could expand.

There are lots of advantages to retired life preparation, including: The primary reason retirement preparation is very important is that it will give you and also your enjoyed ones with economic protection. As mentioned, Social Protection is not most likely to adequately attend to you during retirement, specifically as individuals live longer lives. In some situations, people need to leave the workforce earlier than expected, either because they can't physically function, or due to the fact that they're stressed out.

Little Known Facts About Retirement Planning.

You won't need to choose from an area of anxiety when you know that your specific retirement account or firm pension is established up to take treatment of you as well as your family members in the future. If you collaborate with a tax obligation advisor on your retirement, it can be structured to lessen the quantity of tax obligations you'll pay on the cash you've saved.

If you have to worry regarding cash during retired life, it's not going to be a pleasurable experience. For most individuals, retirement is the moment when they can finally inspect points off their bucket checklist, especially as it associates with taking a trip and also seeing the world. If you have actually planned in advance, this kind of non reusable income ends up being possible.

For some that retire, it could imply selling their residence and relocating to a place with sunnier weather condition. retirement planning. For others, it may indicate obtaining a reverse home mortgage to hang on to a household residential or commercial property. Whatever the instance might be, consulting with a tax obligation advisor concerning the future can make retired life more delightful.

If you make the financial investment in preparing for your retired life now, you won't have to be one of them. Individuals are living much longer, which indicates retired life is getting longer for numerous Americans. And also as individuals age, there often tends to be a rise in surprise expenditures. A partner may create a condition that Discover More Here requirements recovery, full time treatment, or nursing house treatment.

Report this wiki page